Get Paid from Day One of Training: PwC Australia's Paid CPA Training Program

Are you looking for a way to become a Certified Practising Accountant (CPA) without taking on large amounts of debt? PwC Australia’s Paid CPA Training Program offers a unique opportunity to earn a paycheck while obtaining your CPA qualification. This program is perfect for those who want to enter the accounting and finance industry with a stable job from day one.

With a strong reputation as one of the Big Four accounting firms, PwC is a global leader in professional services, offering top-tier training and career development for aspiring accountants. Here’s how PwC’s Paid CPA Training Program can help you turn your aspirations into reality.

Overview of PwC Australia’s Paid CPA Training Program

PwC’s CPA training program provides a structured and rewarding pathway to earning your CPA qualification while gaining valuable industry experience. Here's what you can expect:

• CPA Training is Part of the Job |

1. Comprehensive Training Structure

PwC’s CPA training consists of two key phases:

Phase 1: CPA Exam Preparation and On-the-Job Learning

Duration: Approximately 4-6 month (depending on CPA exam completion).

Details: You’ll start working in audit, tax, consulting, or advisory while preparing for your CPA exams. PwC provides:

• No Upfront Costs, including tuition, registration, and exam costs.

• Paid study leave, allowing you time to focus on passing your exams.

• Mentorship from senior CPAs to guide you through the learning process.

• Internal training sessions to supplement CPA coursework.

Salary During Training: As a full-time PwC employee, you’ll receive a competitive salary starting from AUD 75,000+ per year, depending on your role and experience.

Phase 2: Advanced Career Development as a CPA

Duration: Ongoing professional development.

Details: After earning your CPA designation, you’ll gain opportunities for:

• Salary Increases & Career Progression: PwC offers promotions and salary raises upon CPA completion.

• Specialized Training & Leadership Programs: Develop expertise in tax, audit, consulting, or financial advisory.

• International Career Opportunities: Work in PwC offices across the globe.

2. Financial Benefits

Earn While You Train: Unlike traditional CPA programs where you pay for tuition and exams, PwC covers these costs while paying you a full-time salary.

No Upfront Costs: PwC covers CPA course registration, exam fees, and study materials, saving you thousands of dollars.

Job Security & Growth: Secure a position at one of the Big Four, with long-term career opportunities.

3. Supportive Learning Environment

PwC provides a structured and supportive learning environment to ensure your success:

Flexible Work Arrangements: Balance work, study, and personal life.

Mentorship & Guidance: Work closely with senior CPAs and experienced accountants who support your CPA journey.

Exam Prep & Internal Workshops: Gain access to PwC’s exclusive CPA training resources.

Study Leave: Paid time off for exam preparation, ensuring you have dedicated study periods.

4. Why Choose PwC Australia’s Paid CPA Training Program?

Here’s why PwC’s CPA Training Program stands out:

1. Earn While You Learn• Get paid from day one while preparing for your CPA exams. 2. Career Growth & Job Security• Secure a full-time position at one of the world’s leading accounting firms. 3. Full Benefits Package• Health insurance, paid time off, 401(k) retirement savings plans, and more. 4. Global Career Opportunities• Work with international clients and gain exposure to global finance and accounting trends. 5. High Success Rate• PwC’s structured mentorship and training ensure a high CPA exam pass rate. |

5. The CPA Certification Process with PwC

PwC prepares you for each phase of the CPA qualification process:

- Enroll in the CPA Program (PwC covers the costs)

- Complete CPA Exam Prep Courses (with PwC-provided materials & mentorship)

- Pass the CPA Exams (Paid study leave available)

- Fulfill Practical Experience Requirements (PER) (On-the-job experience at PwC counts toward this)

- Obtain Your CPA Designation & Advance Your Career

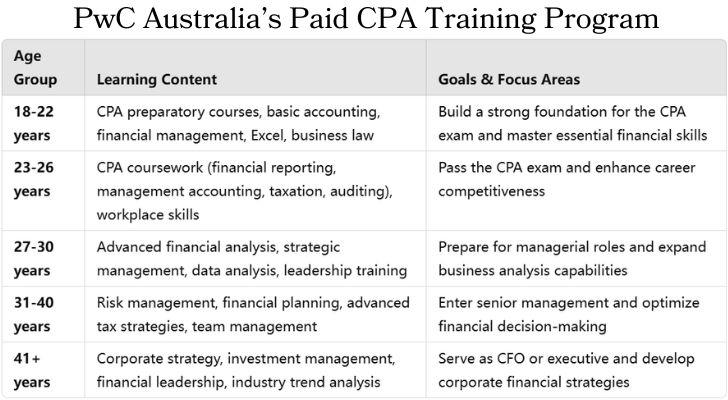

6. Customized Learning for Different Age Groups

How to Apply?

• Graduate Program (for recent graduates)

• Vacation Program (for students in their final years)

• Experienced Hire Program (for those with prior work experience)

7. Conclusion

PwC Australia’s Paid CPA Training Program is an excellent opportunity for aspiring accountants to gain professional certification, real-world experience, and financial stability—all while being paid from day one. With covered CPA costs, full-time employment, and long-term career growth, PwC makes it easy to launch a successful career in accounting and finance.

Ready to kick-start your CPA journey? Apply for PwC’s Paid CPA Training Program today!