How Much Can CFA Holders Earn in Canada? 2025 Latest Salary Report!

What is CFA?

The Chartered Financial Analyst (CFA) designation is a globally recognized certification in finance and investment management, offered by the CFA Institute. It is regarded as the gold standard for professionals working in asset management, securities analysis, investment banking, and wealth management. Holding a CFA credential demonstrates expertise in investment principles, ethics, and financial analysis, making it a valuable asset for finance professionals worldwide.

The CFA program is known for its rigorous curriculum and challenging exams. It covers topics such as financial reporting, equity research, fixed-income analysis, and portfolio management, equipping candidates with the skills needed for high-level financial decision-making. Due to its depth and breadth, earning a CFA designation is a significant achievement that can enhance career prospects and salary potential.

Why is CFA Popular in Canada?

Canada is one of the major global financial centers, with cities like Toronto, Vancouver, and Montreal serving as hubs for banking, asset management, and financial services. Toronto, in particular, is home to many prestigious financial institutions, including the Royal Bank of Canada (RBC), TD Bank, and Scotiabank. The CFA credential is highly valued in the Canadian financial sector for several reasons:

High Recognition: CFA holders enjoy widespread recognition in Canada, particularly within investment firms, asset management companies, and financial consultancies.

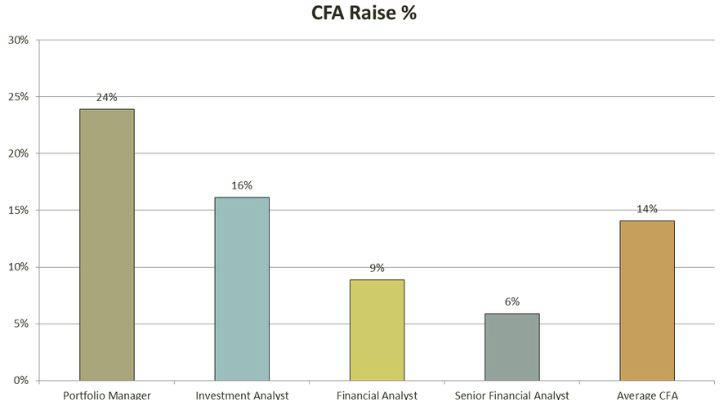

Salary Advantages: Professionals with CFA certification typically earn higher salaries compared to those without it. Employers recognize the rigorous training and knowledge CFA holders possess.

Job Opportunities: The CFA designation provides a significant competitive edge in career fields such as portfolio management, investment analysis, risk management, and investment banking.

Global Mobility: Since the CFA credential is internationally recognized, it opens doors for Canadian professionals seeking opportunities abroad in major financial hubs like New York, London, and Hong Kong.

Salary of CFA Holders in Canada (2025 Latest Data)

Earning a CFA designation can significantly enhance a finance professional’s earning potential. Based on 2025 market data, CFA salaries in Canada vary depending on age, experience, and CFA certification level:

| Age Range | Experience | CFA Level | Annual Salary Range (CAD) |

|---|---|---|---|

| 22-25 | 0-2 years | Level 1 | $55,000 - $75,000 |

| 25-30 | 2-5 years | Level 2 | $75,000 - $110,000 |

| 30-40 | 5-10 years | Level 3 | $130,000 - $300,000 |

| 40+ | 10+ years | Senior Roles | $350,000+ |

Salaries can also vary based on location, company size, and industry. Finance professionals in major financial centers like Toronto and Vancouver generally earn higher salaries due to the concentration of financial institutions and investment firms.

Career Development for CFA Holders in Canada

The CFA designation unlocks numerous career opportunities within Canada’s finance industry. Some of the most common roles for CFA holders include:

Investment Analyst: Conducts in-depth research on stocks, bonds, and other securities to assist portfolio managers in making investment decisions.

Portfolio Manager: Manages investment portfolios for individuals, institutions, or mutual funds, ensuring optimal asset allocation and risk management.

Financial Advisor: Provides financial planning services to clients, helping them achieve their investment and retirement goals.

Risk Manager: Assesses financial and operational risks within investment firms, banks, and corporations to develop mitigation strategies.

Investment Banker: Works on mergers and acquisitions, capital raising, and corporate financial advisory services.

These roles require expertise in financial modeling, investment strategies, and risk assessment—areas that the CFA program extensively covers. Additionally, CFA holders often have an advantage when applying for leadership positions in finance.

How to Obtain a CFA Certification in Canada?

The CFA certification process is demanding, requiring candidates to complete three rigorous exam levels. To become a CFA charterholder, candidates must meet the following requirements:

Obtain a bachelor’s degree or meet the minimum work experience requirement.

Pass all three levels of the CFA exam.

Accumulate four years of relevant work experience in the financial industry.

Adhere to the CFA Institute’s ethical and professional standards.

Each exam level tests different areas of finance and investment knowledge:

Level 1: Focuses on financial principles, ethics, and quantitative methods.

Level 2: Emphasizes asset valuation, corporate finance, and financial reporting.

Level 3: Concentrates on portfolio management, risk analysis, and advanced investment strategies.

The exams are known for their difficulty, and candidates must dedicate substantial time and effort to studying. However, the long-term career benefits and salary increases make the CFA designation a worthwhile investment.

CFA Exam Preparation Resources in Canada

Aspiring CFA charterholders in Canada have access to a variety of resources to aid their exam preparation, including:

CFA Institute’s Official Curriculum: The primary study material provided by the CFA Institute.

Kaplan Schweser Study Materials: One of the most popular CFA exam prep providers, offering study notes, video lessons, and practice exams.

Financial Training Institutions: Providers such as Wiley CFA, PrepSmarter, and local universities offer CFA-focused training programs.

CFA Study Groups and Local Communities: Many cities in Canada have CFA networking and study groups that help candidates stay motivated and share study strategies.

These resources provide candidates with comprehensive study materials, practice exams, and interactive learning tools to maximize their chances of passing each exam level.

Conclusion: Is CFA Worth Pursuing?

For finance professionals looking to advance their careers in Canada, the CFA certification is undoubtedly a high-return investment. While the exams are challenging and require dedication, the career opportunities and high salary potential make it a valuable credential.

The CFA designation provides an edge in the competitive Canadian finance market, particularly in financial hubs like Toronto and Vancouver. It is an excellent choice for those looking to enter or progress in fields such as investment management, risk assessment, and financial analysis.

Whether you’re a recent graduate or a finance professional aiming for higher positions, earning a CFA credential can open doors to prestigious roles, increase salary potential, and enhance career stability. If you're considering a long-term career in finance, the CFA certification is well worth the effort and investment.