Unlock Your Accounting Career: Get Certified with AICPA’s Flexible CPA Program – No Prior Experience Needed

Facing the challenge of high tuition costs or limited accounting experience? The path to becoming a Certified Public Accountant (CPA) can seem daunting, but AICPA, the leading professional organization for accountants, has created a flexible and affordable solution. The AICPA CPA program offers a comprehensive and structured training experience that caters to individuals with no prior accounting background. It provides the opportunity to gain essential knowledge, valuable certification, and hands-on mentorship – all without the burden of exorbitant tuition fees.

Start Your Journey to Becoming a Certified Public Accountant with AICPA’s Comprehensive CPA Program

In today’s competitive job market, the demand for skilled accountants is higher than ever. With businesses across all industries needing expert financial professionals, a CPA certification is one of the most respected credentials in the financial world. The AICPA CPA program is designed to provide aspiring professionals with the tools and knowledge required to not only pass the rigorous CPA exam but also succeed in the accounting field.

Key Benefits of AICPA’s CPA Training Program

Comprehensive Curriculum Designed for Success

AICPA’s CPA program delivers a well-rounded syllabus covering core accounting principles, auditing, taxation, business law, and more. From foundational knowledge to specialized expertise, the program is structured to equip individuals with the skills necessary for the CPA exam and a long-lasting career in accounting. This curriculum is continuously updated to reflect the latest industry standards, ensuring that learners are always ahead of the curve.- Core Subjects: Accounting Principles, Financial Reporting, Auditing, Taxation, Business Law, and Regulation.

- Advanced Focus: The program also emphasizes practical skills in financial analysis, critical thinking, problem-solving, and technical accounting skills that are essential for excelling in the accounting profession.

Expert Guidance and Support Every Step of the Way

AICPA’s CPA program offers more than just a set of courses. Participants gain access to experienced mentors who provide ongoing support and personalized guidance. Whether tackling complex accounting topics or preparing for the CPA exam, learners receive valuable insights from seasoned professionals who have years of experience in the field. This mentorship helps individuals better understand real-world applications of accounting principles, ensuring they are prepared for both the exam and their future careers.- Mentorship: Learn directly from professionals who provide advice on career advancement and industry trends.

- Study Materials: AICPA offers exclusive study resources, practice exams, and continuing education opportunities to make sure that students stay informed about the latest developments in accounting.

Flexible Learning Options for Busy Professionals

Recognizing that many aspiring accountants are balancing full-time jobs or personal commitments, AICPA’s program offers flexible learning formats. Whether opting for self-paced online courses, attending live webinars, or a hybrid approach, learners have the freedom to choose the study method that best fits their lifestyle and schedule. This flexibility ensures that anyone interested in pursuing a CPA designation can do so without sacrificing work-life balance.- Self-Paced Learning: Study at your own pace, on your own time, with access to online courses and materials.

- Interactive Platforms: Engage with fellow students and instructors through online forums and live webinars, enhancing the learning experience.

Networking and Career Opportunities

Becoming a part of AICPA opens doors to a powerful network of professionals in the accounting field. From webinars to conferences, members can connect with industry leaders and potential employers, increasing their chances of finding job opportunities that align with their career goals. The AICPA’s job placement assistance further aids in securing roles with top accounting firms or corporate financial departments, ensuring a smooth transition into the workforce after certification.- Professional Networking: Access exclusive events and networking opportunities with top accountants and industry experts.

- Career Placement: Benefit from AICPA’s partnerships with leading firms to find job opportunities tailored to your skills and qualifications.

Industry Recognition and Career Growth

A CPA certification is one of the most prestigious and sought-after credentials in the accounting profession. With this certification, individuals not only demonstrate their expertise but also gain access to an expanded range of career options, from corporate finance and taxation to government and non-profit sectors. Additionally, CPA professionals enjoy high earning potential and job stability, making it an invaluable qualification in the accounting field.- High Earning Potential: CPAs enjoy competitive salaries, with the potential for increased compensation as experience grows.

- Career Advancement: With a CPA certification, individuals can progress into specialized areas like forensic accounting, tax consulting, or audit management.

Why the CPA Career is the Right Choice

The demand for accountants and auditors continues to rise. According to the U.S. Bureau of Labor Statistics, the accounting profession is expected to grow by 6% over the next decade, making it one of the most stable career choices in today’s economy. By earning a CPA certification through AICPA’s training program, individuals position themselves for long-term career success in this high-demand field.

A CPA credential not only provides job security but also unlocks a wealth of career opportunities. Whether interested in auditing, financial reporting, or taxation, the AICPA CPA program offers the training and resources necessary to pursue a range of specializations within the accounting profession.

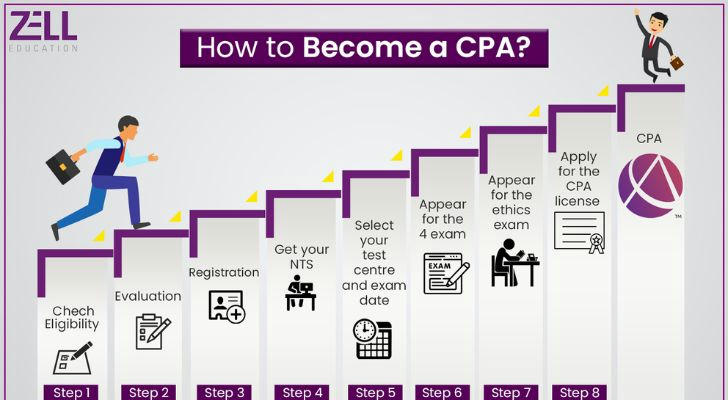

How to Get Started with AICPA’s CPA Program

The path to becoming a Certified Public Accountant starts with joining the AICPA CPA program. With clear steps and a comprehensive learning experience, individuals can take charge of their professional development.

- Explore Program Details: Visit AICPA’s official website to learn more about the course structure, prerequisites, and key offerings.

- Enroll in the Program: Once you’re ready, complete the enrollment process and ensure all necessary documents are prepared for the next steps.

- Begin Learning and Preparing for the CPA Exam: Once enrolled, start your educational journey and prepare for the CPA exam to achieve certification.

Conclusion

AICPA’s CPA training program offers a structured, accessible, and flexible path to becoming a Certified Public Accountant. With comprehensive course offerings, expert mentorship, flexible study options, and valuable networking opportunities, this program ensures individuals are fully equipped to succeed in the accounting profession. Whether seeking a career change or advancement in the field, AICPA’s CPA program provides the tools and certification necessary for success.

For those ready to take the next step in their accounting career, AICPA offers the ideal environment to gain the skills, knowledge, and credentials needed to thrive in a dynamic and high-demand industry.